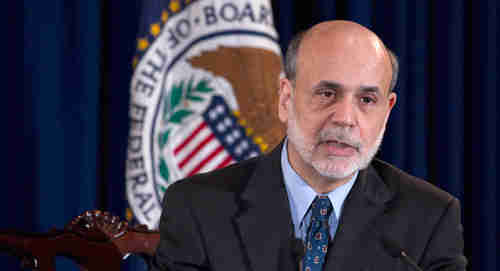

Fed Chairman Ben Bernanke is considered the world’s leading expert on the Great Depression, and how to avoid another one. His strategies have been followed not only in the Unitied States, but also in Europe, Japan, and many other countries. So analysts around the world were shocked on Wednesday by the gloomy economic outlook announced by Federal Reserve and Fed Chairman Ben Bernanke, at his second press conference ever. According to Bernanke’s theory, the world should be recovering strongly by now.

|

| Ben Bernanke on Wednesday (Politico) |

Many economists, including Bernanke, had predicted that the economy would start growing by now, and would be quickly growing by the end of the year. This is the same kind of forecast that we’ve been hearing for three years. All bad news was always transitory, and the “V-shaped” recovery was always going to start next quarter.

However, on Wednesday, a very somber Bernanke said that the economic outlook, especially for jobs and housing, is significantly worse than his last outlook, just two months ago. His gloom was confirmed on Thursday by new data that indicates that new home sales are still falling, while unemployment benefit applications are still increasing, according to AP.

I actually have a great deal of respect for Bernanke as a man, even though I’ve criticized him very harshly in the past. The reason is that he is apparently an honest, decent man who says what he believes without spinning it. This is in contrast to politicians in Washington and Brussels, and bankers on Wall Street, who scream “sleaze” every time they open their mouths. We’ve recently had the spectacle of Jean-Claude Juncker, head of the European finance ministers, being quoted as saying, “When it becomes serious, you have to lie,” just after he’d been caught in a number of lies about the bailout of Greece.

In 2007, as the financial crisis was beginning, I wrote about Ben Bernanke’s great historic experiment, how he was applying the lessons of his academic studies to his management of the financial crisis. I wrote that Generational Dynamics theory tells us that his strategy cannot possibly work. Now, nearly four years later, this has proven to be true.

The Principle of Maximum Ruin

As I wrote recently in “Revisiting the ‘Principle of Maximum Ruin,’” mainstream macroeconomic models are completely static in time. Economists assume that the same macroeconomic model that worked in the 70s and 80s also works today, an assumption which is completely absurd on its face, since the economy at that time was being run by the extremely risk-averse generations of survivors of the Great Depression. As I’ve pointed out many times, economists have been consistently wrong about everything, at least since 1995. They didn’t predict and can’t explain the 1990s tech bubble, the real estate and credit bubbles, the financial crisis since 2007, where we are today, and what’s coming next year. Their predictions are no better than flipping a coin.With regard to Ben Bernanke, I’m reminded of the old joke about the guy who says, “I used to have six theories about raising children. Now I have six children and no theories.”

- Bernanke used to believe that the Great Depression could have been avoided simply by the Fed lowering interest rates. If that wasn’t enough, then the Fed could inject money into the economy by other means. Now, after almost four years of interest rate decreases, stimulus packages, bailouts and quantitative easing, we can see that Bernanke’s theory has apparently been disproven.

- Bernanke used to believe that “deflation is impossible with a ‘fiat’ currency, because the central bank can simply print more money, preventing deflation.” This has already been disproved by the experience of Japan, which is still in a deflationary period more than 20 years after its real estate and credit bubble burst, and the Tokyo stock exchange crashed.

- Bernanke used to say that he didn’t believe in bubbles. That was before the huge real estate and credit bubbles that are now finally widely recognized as bubbles.

- In 2004, I was highly critical of Bernanke’s claims to the effect that the economy was being saved by Fed policy statements — that the mere publication of the Fed’s view of the economy is keeping the economy under control. I considered, and still consider, this claim by Bernanke to be extremely bizarre because it completely ignores fundamentals. The economy is controlled by economic fundamentals, not by words published by the Fed, no matter how enlightened and sagacious those words might be. Needless to say, this view by Bernanke has been disproven many, many times over.

- In 2005, I criticized Bernanke for possibly the most bizarre claim of all, that the reason for America’s huge public debt is that there’s a “global savings glut” in other countries, as if they were at fault for America’s debt.

Once the bubble starts bursting, the Fed can’t “print” money fast enough to replace the money that’s being destroyed through deleveraging. All that money that was created through debt the the credit bubble is still being destroyed, and the amount of money being inserted into the economy is less than the amount being destroyed, so deflation occurs, fiat currency or not.

Ben Bernanke’s Great Historic Experiment has been watched, analyzed and copied around the world. So far, it can be said the experiment has not worked anywhere near as hoped. Generational Dynamics predicts that it will turn out to have been a total failure. In view of the gloominess and desperation of Ben Bernanke himself on Wednesday, it’s possible that even he realizes it. Either way, the day of judgment cannot be far off.

Kicking the can down the road

The phrase that you hear on TV with respect to the bailouts in the U.S. and Europe is “kicking the can down the road,” meaning that the bailout only postpones the final default. Several web site readers have asked me recently why we can’t just kick the can down the road forever.The humorous answer is that sooner or later you run out of road, and that does appear to be happening in Europe these days.

But the more serious answer is simply to apply the laws of economics. As I’ve described many times, you can use the Law of Mean Reversion to prove that the tech, real estate, credit and stock market bubbles that we’ve had have to burst, with devastating consequences.

And then you can use the Law of Diminishing Returns to show that attempts to re-flate the bubble by means of bailouts or other liquidity techniques have to fail. The problem is that each bailout has a smaller effect (“diminishing return”) than the previous one had, and so you have to substantially increase the size of each bailout for it to have the same effect as the previous one.

We’ve certainly seen this in Europe in the last year. And with $14.5 trillion in debt, America is going to see the same thing before too much longer. At some point, you really DO run out of road.

Big Peace